are closed end funds safe

The Blackrock Utilities and Infrastructure Trust NYSE. Its a relatively small part of the.

Unlike typical closed-end funds an interval funds shares are not typically listed on a stock exchange.

. Closed-end funds are a type of investment company whose shares are traded in the open market like a stock or ETF. The term closed-end fund CEF is a bit of a double entendre. Therefore short-term downturns do not materially affect them.

In many cases leverage in these assets is viewed as a foregone conclusion what investors must accept in exchange for 8-12 distributions. Choices in Closed-End Funds. Capital does not flow into or out of the funds when shareholders buy or sell shares.

Among the advantages CEFs - unlike open-end mutual funds - trade at a discount or premium to net asset value. A closed-end fund is organized as a publicly traded investment company by the Securities and Exchange Commission SEC. Get this must-read guide if you are considering investing in mutual funds.

The Eaton Vance Tax-Managed Buy-Write Income Fund NYSE. Their yields range from 632 on average for bond CEFs to. A closed-end fund is a type of investment company whose shares are traded on a stock exchange or in the over-the-counter market.

Its assets are actively managed by the funds portfolio managers and may be invested in equities bonds and other securities. CEFs are an option for experienced investors who enjoy market details. Ad Reduced single fund risk with a portfolio of CEFs managed by top fixed-income managers.

Often the fees range from 1-3 of net assets. Closed-end funds are actively managed by a fund manager often use financial leverage to generate more income can invest in various assets eg. Find Out What Services a Dedicated Financial Advisor Offers.

The closing price and net asset value NAV of a funds shares will fluctuate with market conditions. Closed-end funds CEFs can be one solution with yields averaging 673. Closed-end funds offer excellent income potential compared to conventional mutual funds ETFs and dividend stocks but come with a number of complexities.

Stocks bonds and trade. While it is down for the year it also puts out a monthly distribution that yields close to 85. There is no secondary market for the funds shares and none is expected to develop.

Kiplinger and other publications often cater to this demand by producing lists. However closed-end funds have several important differences compared to the mutual. Closed-end funds may trade at a premium to NAV but often trade at a discount.

So for instance a CEF that is valued at 10 may. Like stocks shares are traded on the open market. In this case closed-end funds have more profit potential.

Closed-end funds come with some risk yet also can provide decent yields that may have a place in the income portion of your investment portfolio. Closed-End Fund Definition. Open-end funds use their NAV to determine the price of their shares.

BUI is a closed-end fund that invests in a wide variety of utilities. A closed-end fund or CEF is an investment company that is managed by an investment firm. Like a mutual fund a closed-end fund is a pooled.

Closed-end funds tend to have a longer time period than open-end funds. Interval Funds are unlisted closed-end funds. Interval funds may be leveraged and carry various risks depending upon the underlying assets owned by a fund.

Learn About Our Financial Advisor Services. Along the same lines consider the shares of the Nuveen Credit Strategies Income Fund JQC 654 when looking for. Closed-end funds raise a certain amount of money through an initial public.

The term closed-end. The fixed number of shares issued by a closed-end fund can not be redeemed by investors. Ad Savings Plans Can Be Overwhelming.

Now imagine that a closed-end fund issued the same number of shares at the same price but after it opened to investors the share price of the closed-end fund fell to 8 while the NAV cash value. Closed-end fund definition. Since closed-end funds are usually small niche funds they generally have a much higher management fee than you will find in ETFs.

A CEFs share price is almost always different from its net asset value. Diversified by asset strategy manager. ETB is a good choice.

Pros and Cons of Closed-End Funds. Even closed-end funds CEFs which some investors turn to for relative safety versus individual stocks given CEFs diverse portfolios can. 5 Closed-End Funds Worth Buying On Sale.

The good news on the dividend front is that you can still find plenty of high safe payouts in my favorite corner of the high-yield market. Even closed-end funds CEFs which some investors turn to for relative safety versus individual stocks given CEFs diverse portfolios can sport high leverage of between 30 and 60. An unintended one Im sure and one we can leverage for safe 6 7 and even 8 yields with upside to boot.

Look for Discounts and Premiums. CEF structure has been beneficial to take advantage of key market conditions especially. Compared to SPYs expense ratio of 009 you are paying a lot for the active management.

CEF shares are bought and sold at market price determined by. Part of the Wells Fargo Advantage Funds family EAD is a closed-end fund that invests in the fixed-income markets via junk bonds preferred stock and other instruments that bring higher risk but. A lot of people google terms like best CEFs to buy in 2021 or top high-yielding closed-end funds and other phrases like that.

The closed-end fund can also trade at a premium or above their NAV. Ad Learn why mutual funds may not be tailored to meet your retirement needs.

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

What Is Mutual Fund Mutuals Funds Mutual Funds Investing Safe Investments

Difference Between Epf And Ppf Income Investing Investing Basic

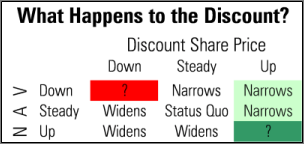

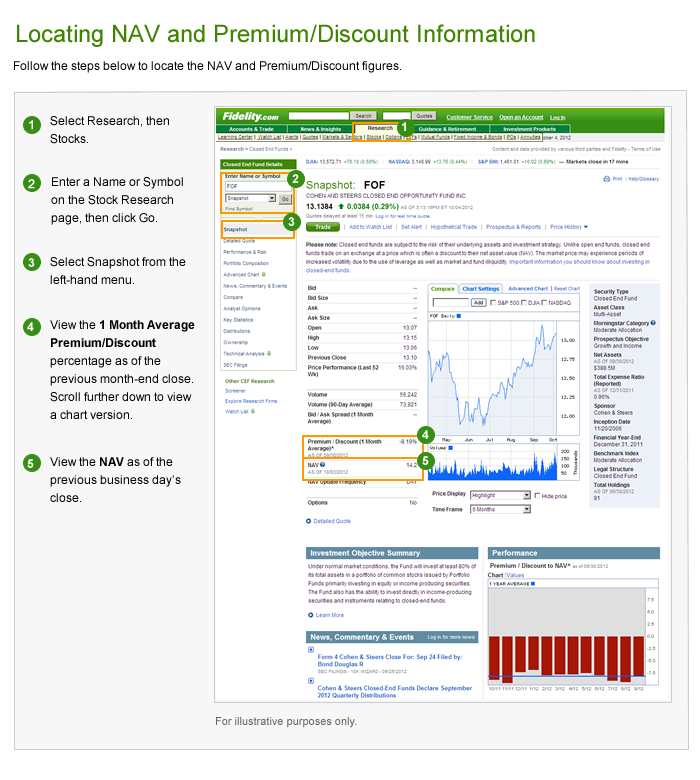

Closed End Fund Cef Discounts And Premiums Fidelity

/mutual_funds_paper-5bfc2e2c46e0fb00260ba168.jpg)

Trading Mutual Funds For Beginners

Socal Safes B Rate Safe And Utility Chest Uc 2020 Cash Management Safe Door Armed Robbery

Closed End Fund Cef Discounts And Premiums Fidelity

Difference Between Open Ended And Closed Ended Mutual Funds

The 2 Best Monthly Dividend Stocks Free Bonus Strategy The Money Snowball Income Investing Investing Money Dividend Investing

What Is A Closed End Fund And Should You Invest In One Nerdwallet

Capital Protection Oriented And Dual Advantage Mutual Funds Mutuals Funds Investing Fund

What Are Closed End Funds Fidelity

Extrategic Dashboard Seasonal Timing Strategy Updated Seasons Strategies Investing

The 2 Best Monthly Dividend Stocks Free Bonus Strategy The Money Snowball Dividend Stocks Dividend Investing Apps

Understanding Closed End Vs Open End Funds What S The Difference

Saving Money In 6 Unusual Easy Ways 130 A Month In 2020 Saving Money Personal Financial Planning Setting Up A Budget